Copy trading appeals to beginners who want structured guidance, as well as more experienced traders seeking to diversify their participation in the markets. Instead of analysing every price movement or technical signal, traders can observe and replicate strategies executed by other traders, while remaining exposed to the same market risks.

By mirroring the decisions of a selected trader, users gain real-time exposure to professional trading behaviour while still retaining control over allocation and risk settings. Over time, this blend of automation and observation can help traders better understand strategy execution, risk management, and how different asset classes behave under changing market conditions.

Quick summary

- Copy trading allows you to mirror the trades of experienced traders automatically.

- It works by selecting a strategy provider, allocating funds, and allowing the platform to execute trades in parallel.

- You control allocation, risk settings, and when to stop or pause copying.

- Key features include diversification, exposure to different trading approaches, and reduced need for constant market monitoring.

- Key risks include market volatility, fluctuations in provider performance, and execution discrepancies.

- Deriv cTrader offers transparent performance data, allocation control, and demo access for new users.

What is copy trading?

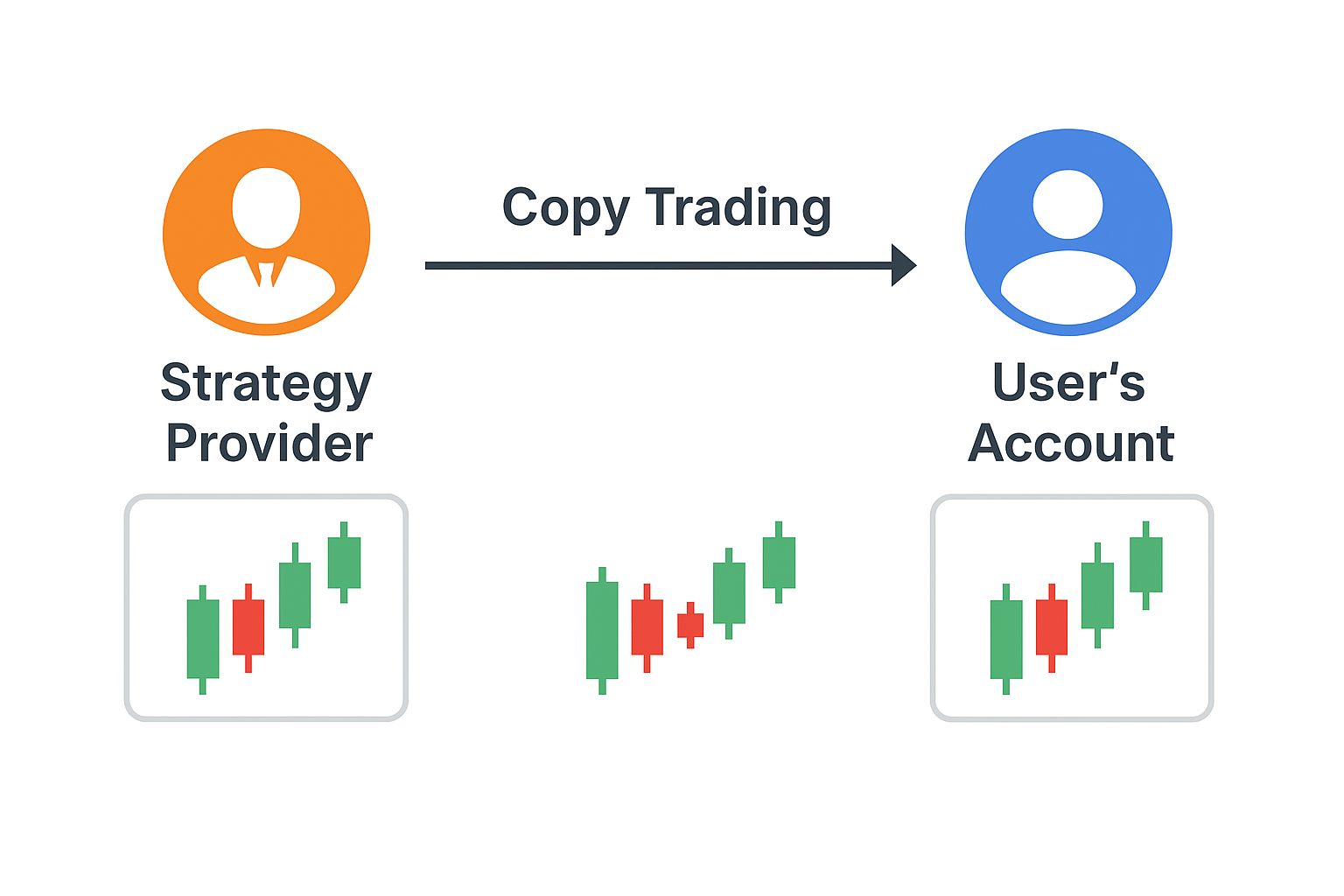

Copy trading is the practice of linking your trading account to that of a chosen trader, often referred to as a strategy provider, so that your account automatically opens, manages, and closes positions in alignment with theirs. While terms like social trading and mirror trading are often used interchangeably, copy trading specifically refers to the automatic replication of another trader’s actions.

Social trading usually focuses on community discussions and manual copying, while mirror trading often involves rule-based systems. Copy trading sits between the two by combining trader-level choices with automated execution.

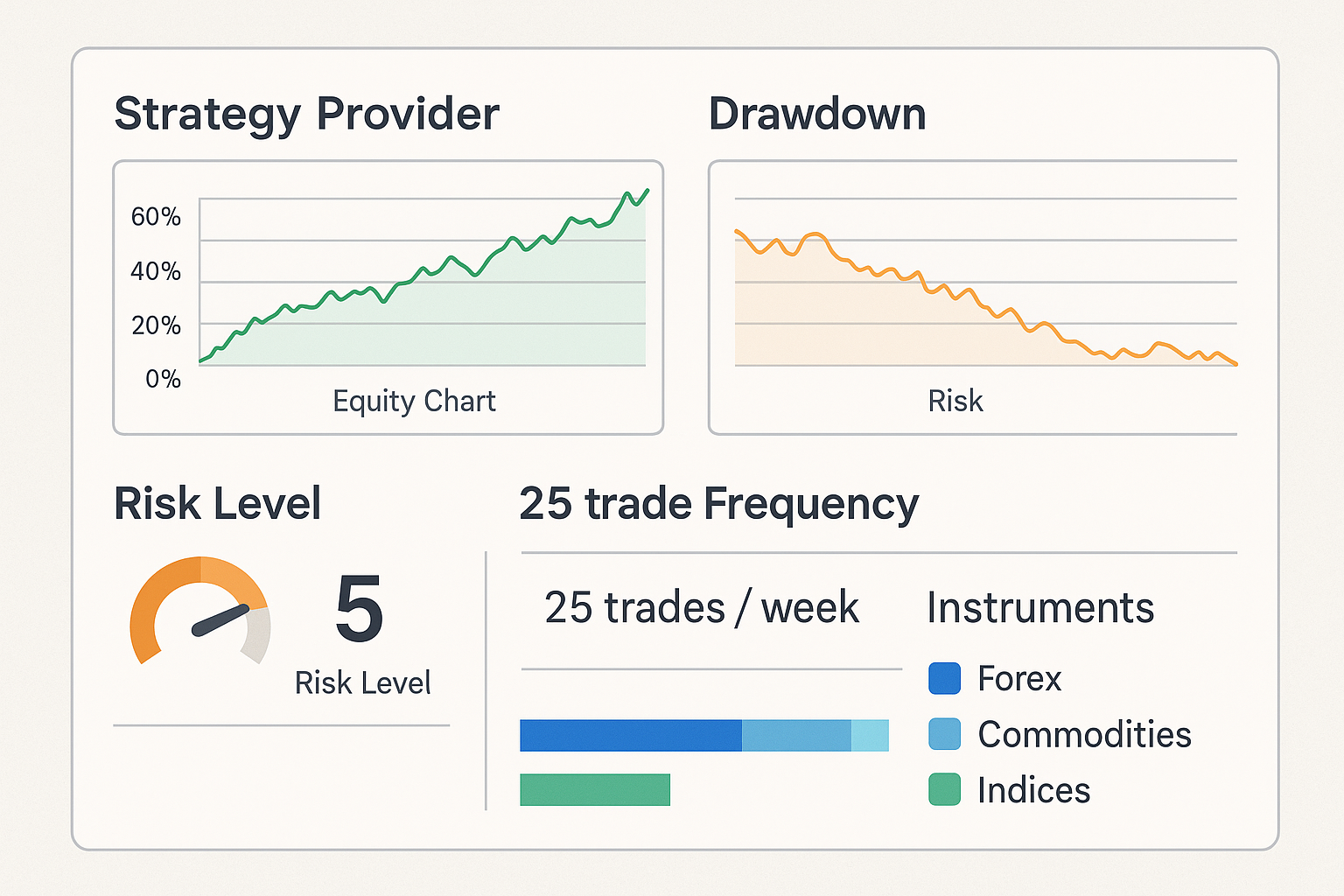

Modern platforms provide detailed information about strategy providers, including profitability trends, drawdown history, preferred instruments, and trading frequency. This allows users to make informed decisions before choosing whom to follow.

How does copy trading work?

Copy trading follows a consistent process across most platforms.

1. Choose a platform

A reliable copy-trading platform tracks the performance of its providers and manages order execution. Platforms like Deriv cTrader offer transparent dashboards displaying performance charts, drawdowns, average monthly returns, instrument focus, leverage usage, and trading rhythm.

2. Review and select strategy providers

Selecting the right provider is crucial. Important factors include:

- Performance history: Look for consistency rather than one-time spikes.

- Risk behaviour: Maximum drawdown, position size, and volatility patterns reveal how a provider manages risk.

- Instruments traded: Providers focusing on forex, indices, or commodities will exhibit different behavior.

- Style: Scalping, swing trading, and trend following each carry different risk levels.

- Execution frequency: Fast strategies may respond differently to market volatility compared to slower ones.

3. Allocate your funds

Once a provider is selected, you decide how much capital to assign. Many platforms allow proportional copying, ensuring your risk exposure aligns with your account size.

4. Automated execution

Trades are copied automatically. When a provider opens, adjusts, or closes a position, your account performs the same action. Small differences can occur due to:

- Price movements between the signal and execution

- Liquidity

- Execution speed

- Minimum trade sizes

- Slippage in fast-moving markets

While performance may not match exactly, the direction and intent remain the same.

5. Monitor and manage risk

Copy trading still requires oversight. You may pause copying, adjust allocation, close trades manually, or change risk settings. Regular monitoring helps you ensure the provider's approach aligns with your goals.

How does copy trading work for beginners?

Beginners often choose copy trading because it shifts the focus from independent trade analysis to observing how experienced traders manage positions in live market conditions. The automated nature of the system allows them to observe strategies in real time while gaining practical exposure.

Platforms present performance data in accessible formats, helping new users understand trends, volatility, and risk before committing funds. Beginners are encouraged to start small, monitor trades frequently, and diversify across multiple providers.

How can strategy providers improve your copy trading results?

Strategy providers drive the performance of any copy-trading setup. A reliable provider may offer:

- Clearly defined strategies

- Consistent historical results

- Lower drawdowns

- Stable execution patterns

- Transparent trading behaviour

Daniel Rees, Professional Forex Trader, adds:

“A strategy provider’s drawdown tells you far more about their discipline than their profit curve. Consistency always beats aggressive spikes in performance.”

Choosing providers with well-documented track records can help traders better understand how a strategy has behaved under different market conditions.

What are the key risks in automated trading?

While automated systems reduce manual effort, they come with risks:

Aisha Karim, Deriv Risk Specialist, elaborates:

“Automated trading removes emotional decision-making, but it also amplifies structural risks. Traders should monitor behaviour changes in their chosen providers.”

1. Provider performance changes

Even strong traders experience losses. Past performance is not indicative of future results.

2. Market volatility

News events, economic shifts, and global uncertainty can affect execution and amplify risk.

3. Execution differences

Prices, spreads, and speed can vary between the provider and the copier.

4. Reduced control

While automation is helpful, it means trades can run longer than expected unless you intervene.

5. Strategy transparency

Limited information about how a provider trades can make risk assessment more challenging.

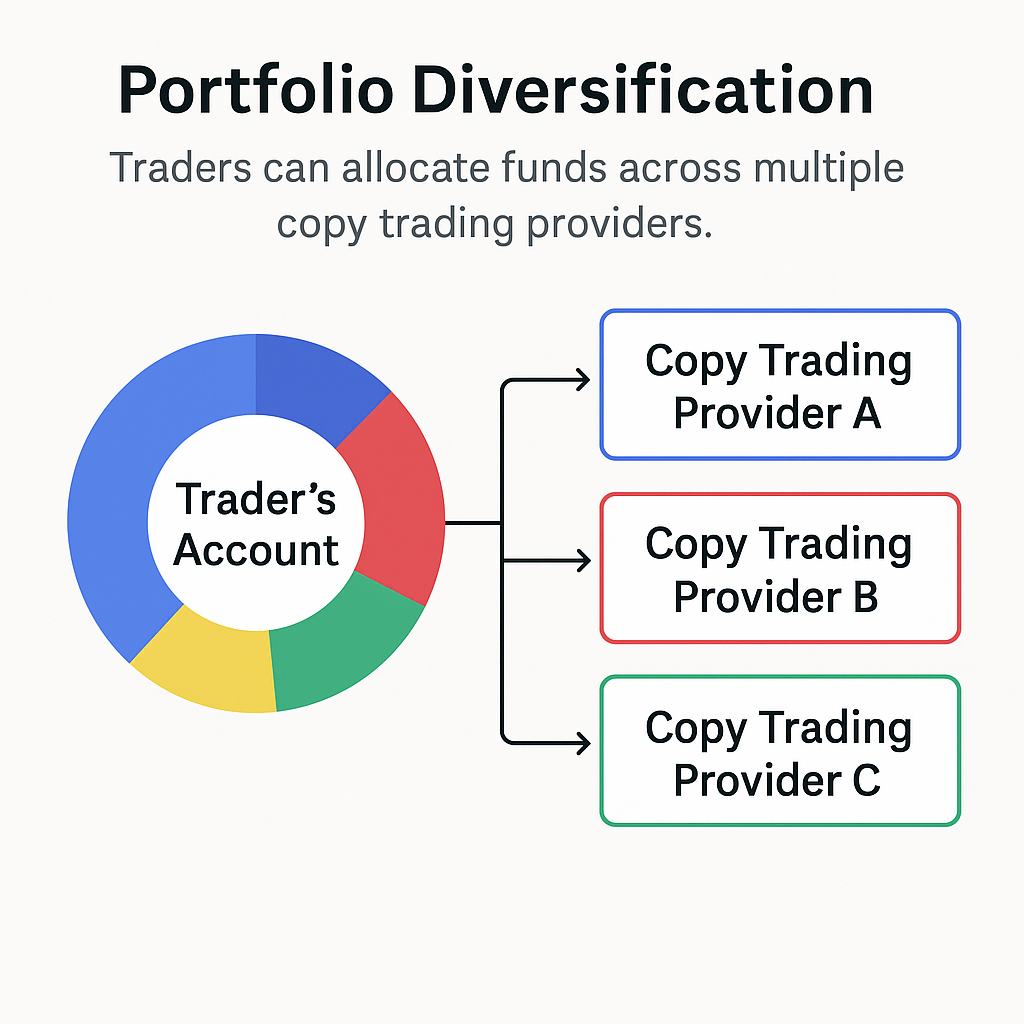

How does copy trading support portfolio diversification?

Copy trading allows you to distribute capital across multiple providers with different strategies and asset preferences. This diversification can help reduce risk concentration.

For example, you might:

- Follow one provider who focuses on forex trend following

- Choose another who trades commodities

- Allocate a portion to a provider specialising in short-term index strategies

Jason Miller, Multi-asset Portfolio Manager, mentions:

“Diversification works best when your providers use genuinely different strategies, not slightly modified versions of the same approach.”

This mix can help reduce reliance on a single market or strategy, though it does not eliminate overall trading risk.

How do trading strategies differ on Deriv cTrader?

Deriv cTrader features a variety of strategy providers who use different trading approaches, including:

- Trend-following strategies

- Countertrend systems

- Volatility-based entries

- Multi-asset diversification approaches

- Swing trading and medium-term positioning

The platform presents detailed metrics for each provider, helping users compare strategies based on profitability, risk tolerance, and market behaviour.

How does this trader-focused analogy explain copy trading?

Copy trading works similarly to subscribing to a research analyst who not only explains market moves but also executes the trades for you. You still choose how much to allocate and when to stop, but you rely on the analyst’s structured approach to guide your exposure. This analogy supports understanding without replacing technical explanations.

What tips can help new copy traders?

- Start with a demo account before committing real funds.

- Allocate smaller funds initially.

- Diversify across several providers.

- Review performance regularly.

- Set risk limits that match your comfort level.

- Avoid relying solely on past performance.

Deriv Trading Education Lead, Sarah Tan, furthers:

“New traders should treat their first month of copy trading as research rather than profit-seeking. The goal is to understand behaviour, not maximise returns.”

Is copy trading right for you?

Copy trading may suit traders who want a structured way to gain exposure to different trading approaches. It still requires awareness, ongoing evaluation, and risk management.

With a disciplined approach, copy trading can support skill development and provide exposure to a broad range of market strategies.

When should copy trading be avoided?

While copy trading can be useful, it may not suit every trader or every situation. Traders with very low risk tolerance may find the drawdowns uncomfortable, even when following conservative strategy providers. Similarly, those who prefer full control over trade entry, exit, and position sizing may feel constrained by automated execution.

Copy trading may also be less effective during unusual market conditions, such as periods of extreme volatility or low liquidity, when historical strategies struggle to adapt. In these situations, monitoring performance closely or pausing copying altogether can be a sensible risk-management decision.

Understanding when not to copy is just as important as knowing how to start. Treating copy trading as one tool within a broader trading approach helps maintain realistic expectations and supports long-term decision-making.

Quiz

What’s another name for copy trading?